Wise.com

Reviews

0 out of 5 stars

0 reviews

wise.com

#11 inCurrency Exchanges

Reviews & Testimonials

Wise.com Reviews

No reviews of Wise.com yet, but that doesn't mean it's not great!

Try it and let others know what you think.

Wise.com Reviews

0 out of 5 stars

Based on 0 reviews

Review data

1 star reviews

- 0%

2 star reviews

- 0%

3 star reviews

- 0%

4 star reviews

- 0%

5 star reviews

- 0%

Share your thoughts

If you've used this product, share your thoughts with other customers and help them by submitting a Wise.com review.

Questions & Answers

Wise.com Questions

No questions about Wise.com yet-be the first to ask!

Have something on your mind?

Have a question?

If you have any questions about this product, feel free to ask! Whether it's about features, compatibility, or anything else.

Third party review

Wise.com Review

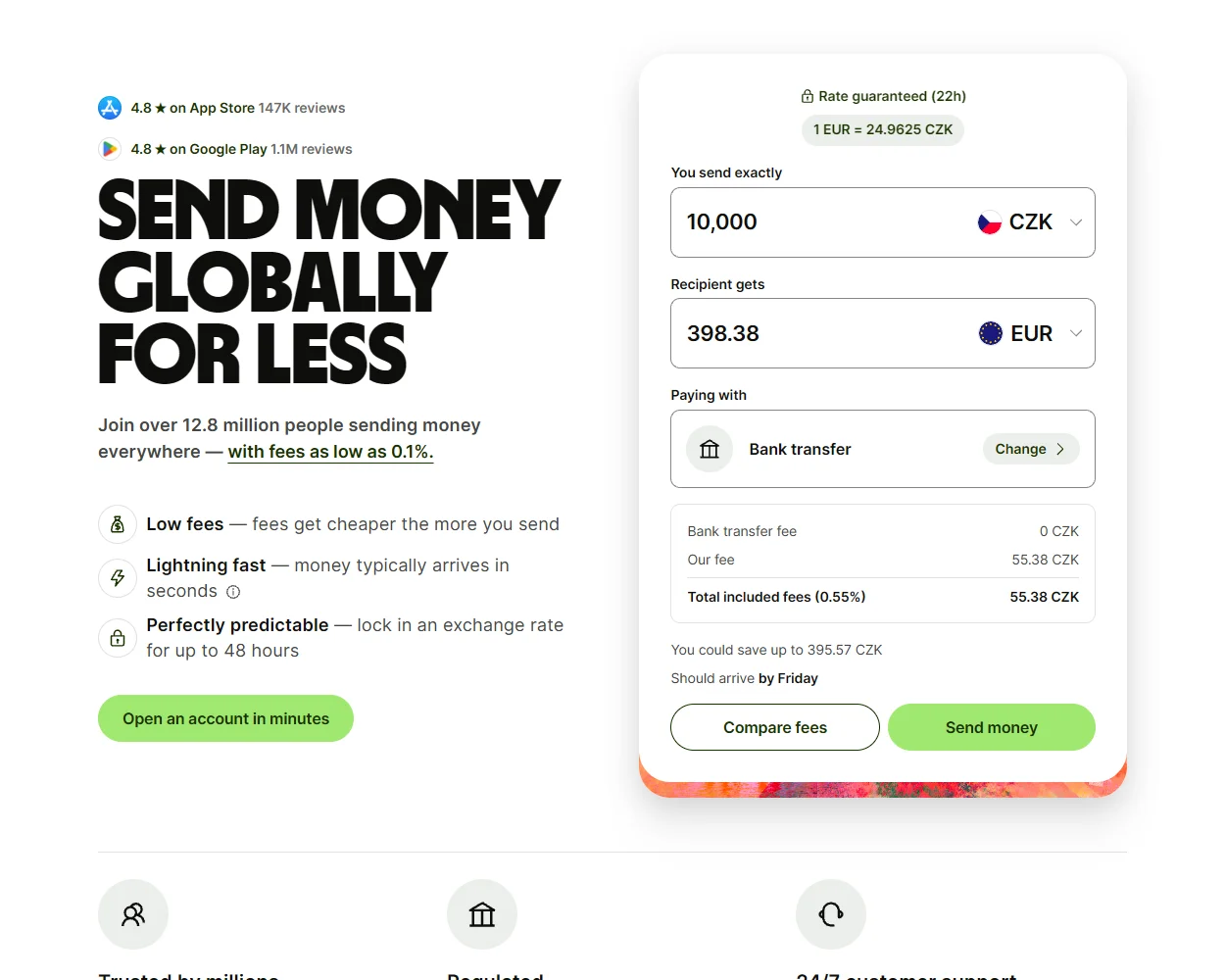

One of the standout features of Wise is its multi-currency account, which allows users to hold and convert over 50 currencies at the real exchange rate. This means that customers can convert their funds at a rate that's closer to the market rate, avoiding the markups typically imposed by traditional banks.

The platform also offers a debit card that can be used internationally, making it convenient for travelers or anyone who regularly makes purchases in foreign currencies. With the Wise debit card, users can spend money directly from their multi-currency account without worrying about conversion fees that add up.

Another significant advantage of Wise is its low and transparent fee structure. Unlike many banks that hide charges in unfavorable exchange rates, Wise clearly outlines its fees upfront. This transparency helps users understand exactly what they will pay for a transfer or currency conversion, building trust and confidence in the service.

Wise's speed is another noteworthy feature. Transactions can be completed within a few hours, while international bank transfers can take several days. This fast service can be especially beneficial for businesses that need to send payments quickly or receive funds from overseas clients.

However, Wise is not without its limitations. While it excels in international transactions, it does not offer some traditional banking services, such as loans or savings accounts, which might deter users looking for a one-stop financial solution. Additionally, while Wise is expanding globally, it may not support all countries for sending money, thereby limiting accessibility for some potential users.

Wise also has a customer support system that is generally well-regarded, though response times can vary. For urgent issues, users may find quicker resolutions through the extensive resources available on their website, including FAQs and instructional guides.

In summary, Wise.com presents itself as a robust solution for anyone needing to manage international finances. With its multi-currency accounts, transparent fees, and fast transfer speeds, Wise stands out in the crowded fintech space.

While it lacks some features typical of traditional banks, the focus it places on currency exchange and international payments makes it a strong choice for travelers, expatriates, and businesses involved in international trade. Overall, Wise represents a modern approach to currency management that could significantly simplify financial transactions across borders.

Customers also bought

Wise.com Alternatives

4 out of 5 stars

3 reviews

3 out of 5 stars

4 reviews

0 out of 5 stars

0 reviews

0 out of 5 stars

0 reviews

0 out of 5 stars

0 reviews

0 out of 5 stars

0 reviews

0 out of 5 stars

0 reviews

0 out of 5 stars

0 reviews

General Data

Wise.com Information

- Category

- Currency Exchanges

- Languages

- English

- Product Type

- Digital Product

Summary

Wise.com Features

Explore Wise.com features below, and see why users search for Wise.com reviews before making their decision.

- Smart Currency Alerts

- Wise.com now offers customizable currency alerts that notify users about significant exchange rate changes. Users can set preferences to receive

updates directly. - Smart Budgeting Tool

- Wise.com introduces a smart budgeting tool that assists users in tracking their spending across multiple currencies. It provides insights to enhance financial planning.

- Instant Transaction Insights

- Wise.com has launched a feature that provides instant transaction insights. Users can view detailed breakdowns of fees and conversion rates, enhancing transparency.

- Multi-Currency Savings Goals

- Wise.com features a goal-setting tool that helps users save in multiple currencies. Set targets, track progress, and adjust strategies effortlessly.

- Automated Expense Sharing

- Wise.com has added an automated expense sharing feature that allows users to split bills and payments with multiple recipients. It simplifies managing group expenses.

- Real-Time Currency Comparison

- Wise.com now provides a feature that allows users to compare current exchange rates against historical data.

This assists users in making informed conversion decisions.