Rebuilding Society

Reviews

0 out of 5 stars

0 reviews

rebuildingsociety.com

#1 inSmall Business Loans

Affiliate program available

18 years in the business

SSL secured by Let's Encrypt

Reviews & Testimonials

Rebuilding Society Reviews

No reviews of Rebuilding Society yet, but that doesn't mean it's not great!

Try it and let others know what you think.

Rebuilding Society Reviews

0 out of 5 stars

Based on 0 reviews

Review data

1 star reviews

- 0%

2 star reviews

- 0%

3 star reviews

- 0%

4 star reviews

- 0%

5 star reviews

- 0%

Share your thoughts

If you've used this product, share your thoughts with other customers and help them by submitting a Rebuilding Society review.

Questions & Answers

Rebuilding Society Questions

No questions about Rebuilding Society yet-be the first to ask!

Have something on your mind?

Have a question?

If you have any questions about this product, feel free to ask! Whether it's about features, compatibility, or anything else.

Third party review

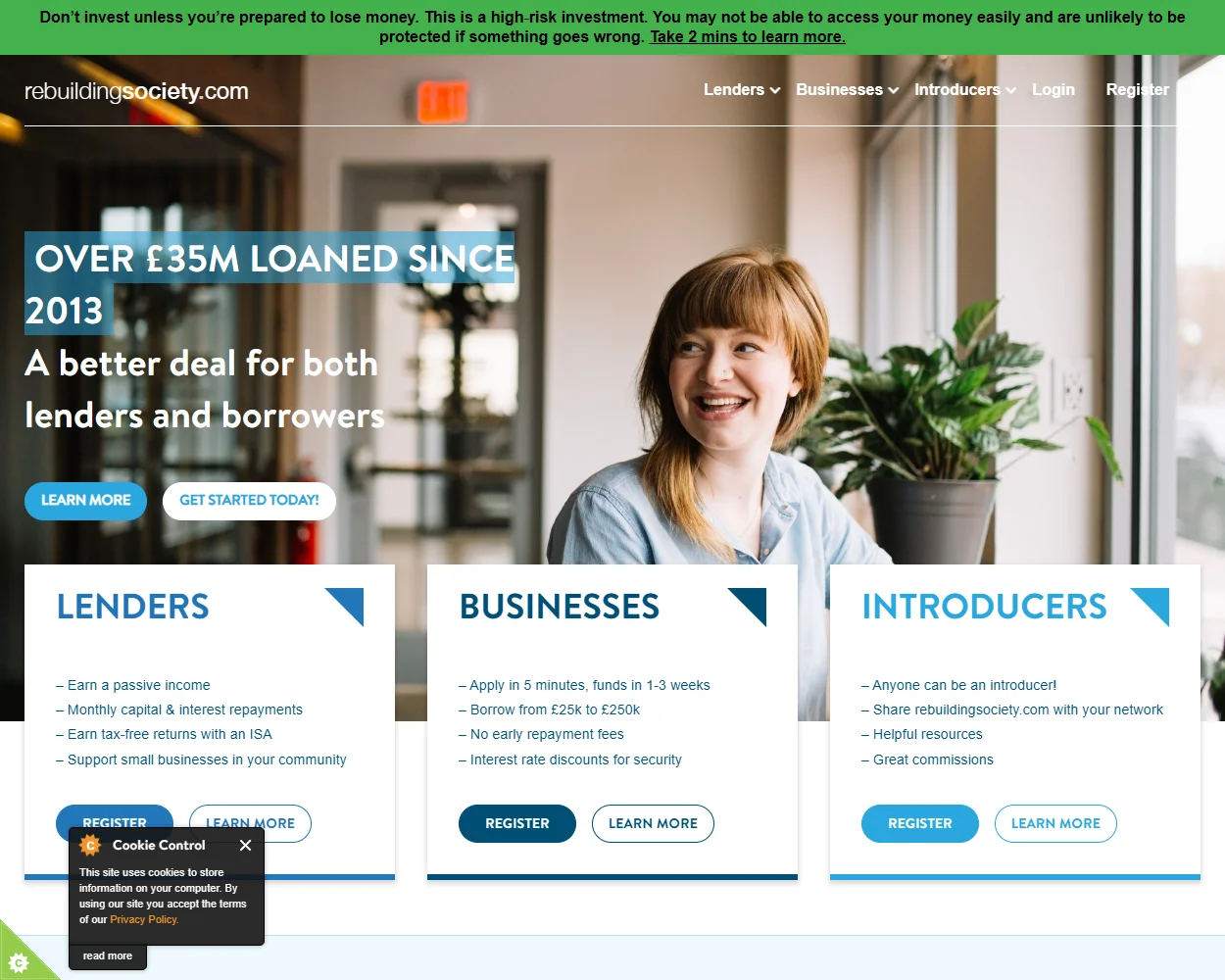

Rebuilding Society Review

One of the standout features of Rebuilding Society is its focus on social impact. The platform not only offers traditional lending services but also emphasizes supporting communities by funding local businesses and projects. This social mission adds an appealing dimension for those who want their investments to contribute positively to society.

Another key feature is its user-friendly interface, making it accessible to both novice and experienced investors. Setting up an account is straightforward, and users can easily navigate through the different sections, whether they are looking to borrow or invest. The platform also provides detailed information about each borrowing opportunity, which aids investors in making informed decisions. Transparency is a significant aspect of the platform, ensuring that users understand how funds are utilized and the risks involved.

Pros of using Rebuilding Society include a diversified investment strategy, as investors can choose from various loan types and risk levels. This allows for tailoring an investment approach that aligns with individual risk tolerance and financial objectives. The potential for competitive interest rates is another attractive feature, providing an alternative to traditional savings accounts or investment vehicles that may yield lower returns.

However, there are notable limitations to consider. The main drawback is the inherent risk involved in peer-to-peer lending. Borrowers may default on loans, which presents a risk to investors. While the platform conducts due diligence on borrowers, no investment is entirely risk-free. Additionally, the liquidity of investments may be limited, as funds are tied up for the duration of loan agreements.

In terms of support and resources, Rebuilding Society offers various educational materials to help users understand the lending and investing process better. However, the availability of customer support can vary, and some users may encounter delays in responses to inquiries. This can be a concern for those who prefer immediate assistance or have specific questions about their investments.

In summary, Rebuilding Society presents a compelling option for those looking to engage in peer-to-peer lending with a social purpose. Its user-friendly platform, focus on community enhancement, and potential for returns make it appealing to both borrowers and investors. However, prospective users should weigh the risks associated with this investment model and ensure they are comfortable with the possibility of loan defaults. As with any investment decision, a thorough evaluation of personal financial circumstances and goals is advisable.

General Data

Rebuilding Society Information

- Category

- Small Business Loans

- SSL Provider

- Let's Encrypt

- Founding date

- 2008

- Languages

- English

- Product Type

- Service

- Address

- 26 Whitehall RdLeedsUnited Kingdom

Summary

Rebuilding Society Features

Explore Rebuilding Society features below, and see why users search for Rebuilding Society reviews before making their decision.

- Community Investment Insights

- Rebuilding Society offers an innovative feature that analyzes community investment trends.

Users can access detailed reports to make informed decisions. - Investment Sentiment Analysis

- Rebuilding Society features a new tool that gauges user sentiment on community projects.

This helps investors align with popular initiatives. - Investment Project Forecasting Tool

- Rebuilding Society introduces a forecasting tool that predicts the return potential of community investments.

This allows users to strategize effectively. - Investment Education Hub

- Rebuilding Society launches an educational hub that provides users with comprehensive resources on community investment strategies.

This empowers informed decision-making. - Risk Assessment Dashboard

- Rebuilding Society presents a risk assessment dashboard that allows users to evaluate potential risks associated with community investments.

This ensures safer investment choices. - Community Feedback Loop Tool

- Rebuilding Society integrates a community feedback loop tool that allows users to comment on projects.

This fosters deeper engagement and transparency.