Charge.com

$1.00

Reviews

4 out of 5 stars

6 reviews

charge.com

#4 inPayment Processors

Affiliate program available

31 years in the business

SSL secured by GoDaddy.com, Inc.

Reviews & Testimonials

6 Charge.com Reviews

Dave Web

5 out of 5 stars

For further improvement, I encourage the team to consider expanding features to enhance user experience even more. Overall, a solid choice for anyone looking for comprehensive digital payment solutions.

Melissa Zeidwig Rayman

5 out of 5 stars

Ike Eastwood

5 out of 5 stars

Rose Trone

5 out of 5 stars

Tiffany Mccoach

5 out of 5 stars

- Tiffany Lynn

Len Lewis Jr.

1 out of 5 stars

I signed up for an Authorize.Net gateway and was informed that the monthly minimum charge would likely not apply to my account, as I was already paying $25 per month plus a monthly statement fee. However, I ended up being charged the $25 monthly fee.

Overall, this experience has not met my expectations.

Charge.com Reviews

4 out of 5 stars

Based on 6 reviews

Review data

1 star reviews

- 17%

2 star reviews

- 0%

3 star reviews

- 0%

4 star reviews

- 0%

5 star reviews

- 83%

Share your thoughts

If you've used this product, share your thoughts with other customers and help them by submitting a Charge.com review.

Questions & Answers

Charge.com Questions

No questions about Charge.com yet-be the first to ask!

Have something on your mind?

Have a question?

If you have any questions about this product, feel free to ask! Whether it's about features, compatibility, or anything else.

Third party review

Charge.com Review

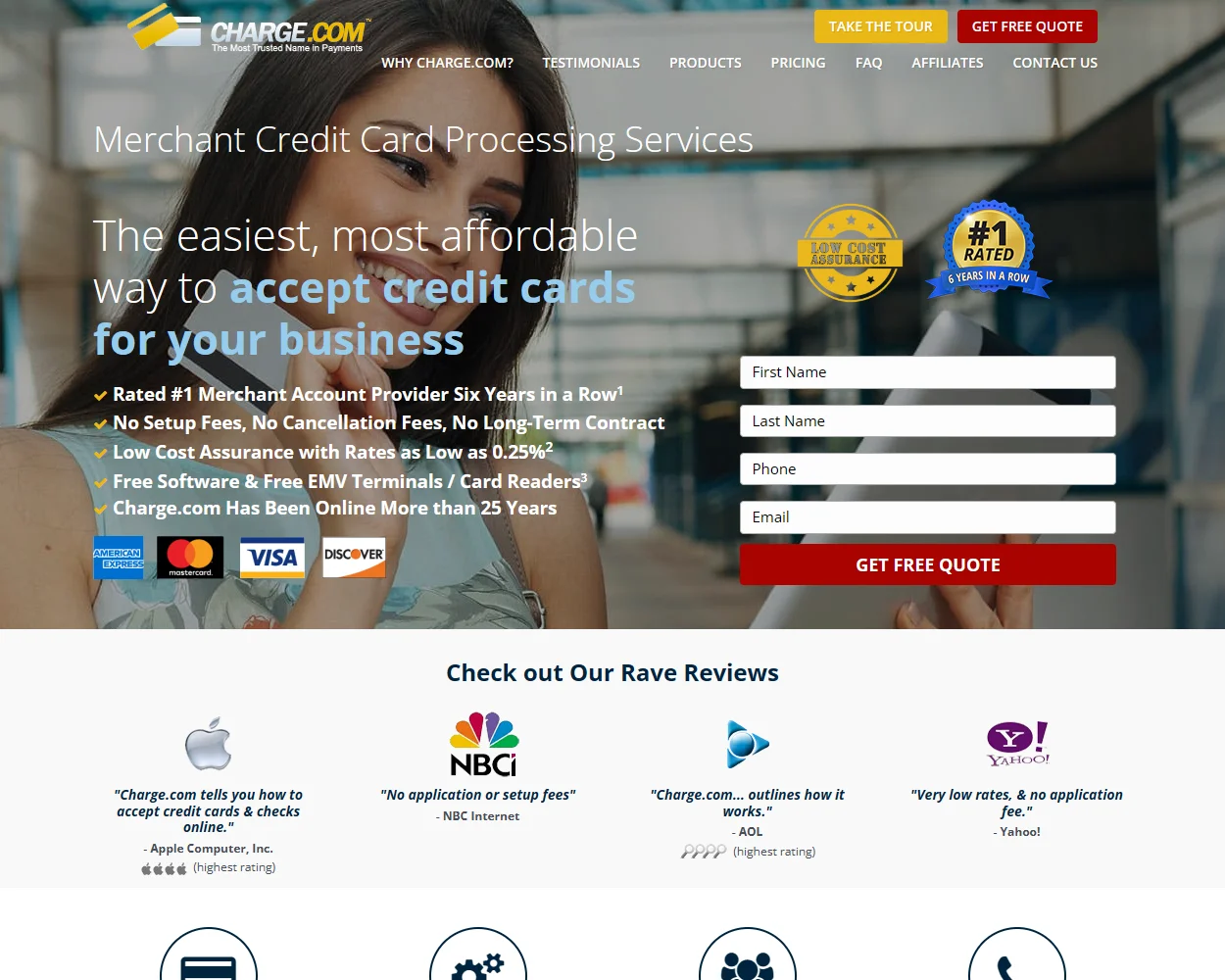

In the ever-evolving world of digital commerce, having a dependable credit card processing service is crucial for business success. Charge.com stands out as a reliable solution for small and medium-sized businesses looking to streamline their payment processing.

Key Features

Charge.com offers a range of features that cater to various business needs. One of its most notable features is the ability to accept a wide range of credit and debit cards including Visa, MasterCard, American Express, and Discover. This flexibility ensures that businesses can cater to a broad customer base.

The platform also provides free setup and integration with existing systems, which makes it an easy choice for businesses that might lack the technical expertise to handle complicated integrations. Additionally, Charge.com offers a virtual terminal which allows businesses to process transactions without a physical card reader. This is particularly beneficial for those operating online or remotely.

Another highlight is their competitive pricing structure. Charge.com boasts one of the lowest rates in the industry, ensuring that businesses can maximize their earnings without worrying about prohibitive fees. They also offer robust security features, including fraud detection and data encryption, vital for maintaining customer trust and protecting sensitive information.

Pros

Charge.com's simplicity and straightforward setup are major advantages. Businesses can start processing payments quickly without significant downtime. Their 24/7 customer support option is another strong point, ensuring that assistance is available whenever needed.

The multi-platform compatibility, including mobile processing solutions, makes it suitable for businesses operating in various environments. Furthermore, Charge.com offers additional services like recurring billing and point-of-sale systems, providing a comprehensive suite of tools for business operations.

Limitations

While Charge.com excels in many areas, there are a few limitations to keep in mind. Some users have reported that the interface, though functional, could benefit from an update to enhance usability and aesthetics. It may not be as visually appealing as some modern alternatives.

Additionally, though their rates are highly competitive, the pricing structure can vary depending on the transaction volume and type. It's important for businesses to thoroughly understand the fee schedule to avoid unexpected costs.

Conclusion

Overall, Charge.com is an excellent choice for businesses looking for a reliable and efficient credit card processing solution. Its ease of use, competitive rates, and extensive support options make it a standout option in a crowded marketplace. While there are potential areas for improvement in the user interface and clarity of pricing, Charge.com remains a strong contender for businesses seeking a comprehensive payment processing system.

Customers also bought

Charge.com Alternatives

0 out of 5 stars

0 reviews

0 out of 5 stars

0 reviews

0 out of 5 stars

0 reviews

3 out of 5 stars

8 reviews

0 out of 5 stars

0 reviews

5 out of 5 stars

1 review

General Data

Charge.com Information

- Category

- Payment Processors

- SSL Provider

- GoDaddy.com, Inc.

- Founding date

- 1995

- Languages

- English

- Product Type

- Service

- Address

- 9715 West Broward Boulevard - Suite 182Plantation, FloridaUnited States

Summary

Charge.com Features

Explore Charge.com features below, and see why users search for Charge.com reviews before making their decision.

- Enhanced User Analytics Tool

- Charge.com now features an advanced analytics tool that offers real-time insights into user behavior and transaction patterns.

This helps businesses make informed decisions. - Seamless Integration Options

- Charge.com now offers a streamlined integration process with popular e-commerce platforms.

This enables businesses to connect their systems effortlessly. - Custom Payment Solutions

- Charge.com introduces customizable payment solutions that adapt to your business model.

This flexibility empowers users to optimize their payment experiences. - Enhanced Security Features

- Charge.com now integrates advanced security protocols that protect sensitive transaction data.

This ensures peace of mind for users and their customers. - User-Centric Payment Insights

- Charge.com introduces a user-centric dashboard that visualizes payment flows and customer trends. This empowers businesses to identify gaps and enhance engagement.

- Smart Payment Reconciliation Tool

- Charge.com has launched an innovative reconciliation feature that automates the matching of payments with invoices. This streamlines accounting processes and reduces errors.