FinMinistry

8 products

finministry.com

FinMinistry empowers users by simplifying personal finance management, offering insightful tools and resources to help navigate budgeting, savings, and financial planning efficiently.

#18 inNetworks

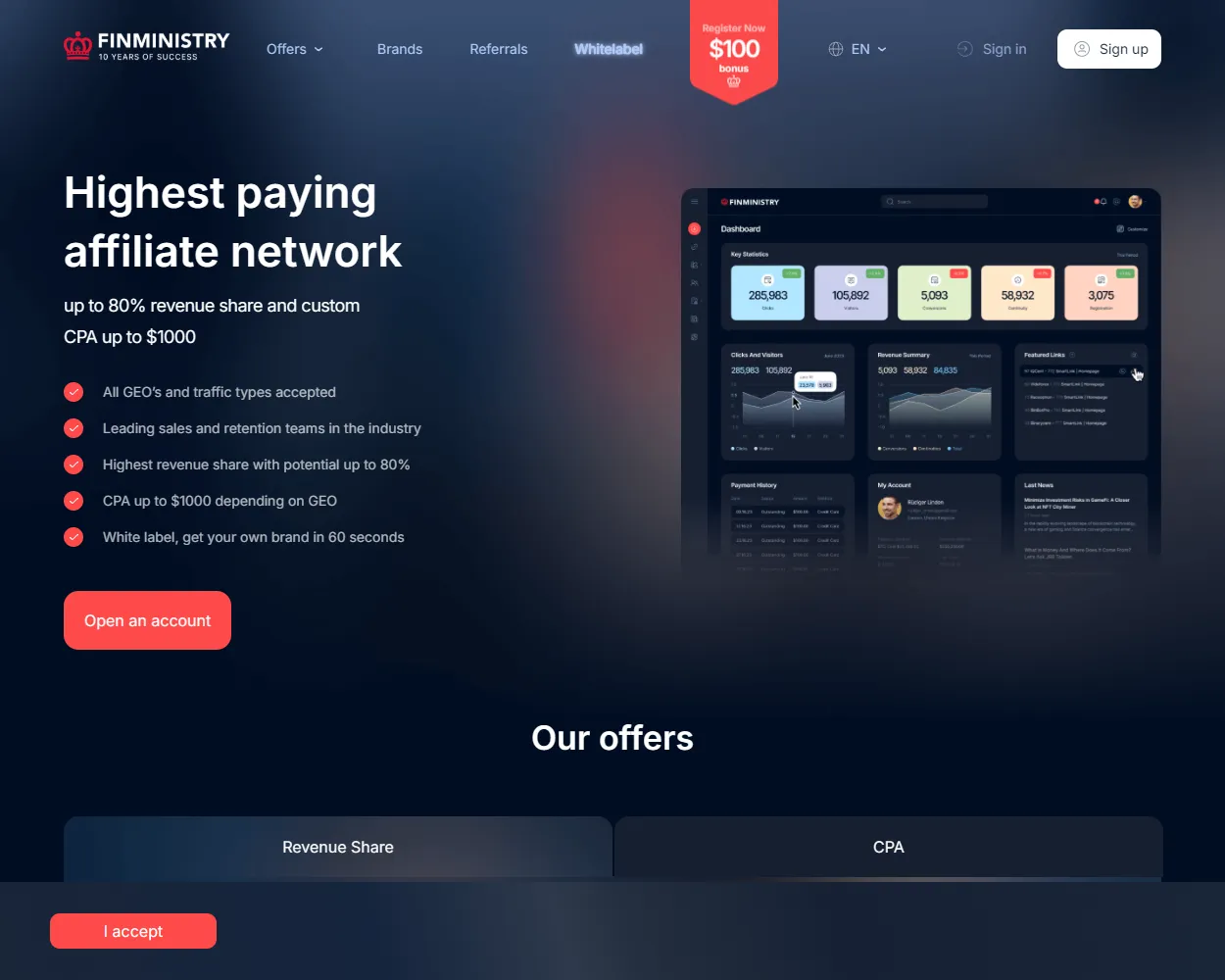

Visual snapshot taken from the FinMinistry site

Affgadgets Guarantee

ProductsFinMinistry Products

FinMinistry Products

Loading...

Loading...

Loading...

Displaying 8 products

BinBot PRO

0 out of 5 stars

0 reviews

Binarycent

0 out of 5 stars

0 reviews

Centobot

0 out of 5 stars

0 reviews

Videforex

0 out of 5 stars

0 reviews

Raceoption

0 out of 5 stars

0 reviews

IQcent

0 out of 5 stars

0 reviews

Daxbase

0 out of 5 stars

0 reviews

Third party review

FinMinistry Review

Streamline Your Finances with FinMinistry

Navigating the financial landscape can be daunting, but FinMinistry offers a powerful digital solution to manage your investments and transactions efficiently. This platform has carved out a niche by providing users with a comprehensive suite of tools designed to optimize financial management.

Key Features

FinMinistry offers a range of features designed to cater to various financial needs. At the forefront is its user-friendly dashboard, which allows users to view and track their financial activities at a glance. This feature is essential for those who prefer seeing their financial health represented through intuitive charts and graphs.

Another standout feature is the automated budgeting tool. Users can set budget limits across different categories, and FinMinistry will track spending patterns, offering insights on where to cut down. The customization aspect is particularly appealing, as it aligns budgeting with personal financial goals.

Additionally, the platform supports integration with multiple financial institutions. This connectivity means users can access accounts and transaction histories from various banks in a single place, reducing the need for multiple apps. It's particularly beneficial for individuals with complex financial portfolios looking for simplicity.

Pros

The ease of use is arguably FinMinistry's strongest advantage. The interface is clean and intuitive, making it suitable for users of all ages. Another significant benefit is the platform's security features. FinMinistry employs industry-standard encryption, ensuring that user data remains protected.

Furthermore, the customer support service provided by FinMinistry is commendable. Users report fast and helpful responses, whether through chat, email, or phone support. This level of support contributes to a positive user experience by ensuring any issues are resolved promptly.

Limitations

Despite its numerous advantages, FinMinistry has its limitations. The free version offers limited features, which may not satisfy users looking for comprehensive solutions without incurring additional costs. Users interested in advanced features like investment analysis or detailed transaction categorization may need to consider upgrading to a paid plan.

Moreover, while the integration with banks is a boon, it occasionally encounters hiccups with certain lesser-known banks, which can result in synchronization delays.

Conclusion

FinMinistry stands out in the digital finance management sector with its combination of user-friendly design and comprehensive tools. While some may find the limitations of the free version restrictive, the platform’s capabilities in budgeting, account integration, and real-time insights present a valuable resource for individuals intent on mastering their financial health. FinMinistry is an excellent choice for those seeking a balance between functionality and ease of use in financial management.

Navigating the financial landscape can be daunting, but FinMinistry offers a powerful digital solution to manage your investments and transactions efficiently. This platform has carved out a niche by providing users with a comprehensive suite of tools designed to optimize financial management.

Key Features

FinMinistry offers a range of features designed to cater to various financial needs. At the forefront is its user-friendly dashboard, which allows users to view and track their financial activities at a glance. This feature is essential for those who prefer seeing their financial health represented through intuitive charts and graphs.

Another standout feature is the automated budgeting tool. Users can set budget limits across different categories, and FinMinistry will track spending patterns, offering insights on where to cut down. The customization aspect is particularly appealing, as it aligns budgeting with personal financial goals.

Additionally, the platform supports integration with multiple financial institutions. This connectivity means users can access accounts and transaction histories from various banks in a single place, reducing the need for multiple apps. It's particularly beneficial for individuals with complex financial portfolios looking for simplicity.

Pros

The ease of use is arguably FinMinistry's strongest advantage. The interface is clean and intuitive, making it suitable for users of all ages. Another significant benefit is the platform's security features. FinMinistry employs industry-standard encryption, ensuring that user data remains protected.

Furthermore, the customer support service provided by FinMinistry is commendable. Users report fast and helpful responses, whether through chat, email, or phone support. This level of support contributes to a positive user experience by ensuring any issues are resolved promptly.

Limitations

Despite its numerous advantages, FinMinistry has its limitations. The free version offers limited features, which may not satisfy users looking for comprehensive solutions without incurring additional costs. Users interested in advanced features like investment analysis or detailed transaction categorization may need to consider upgrading to a paid plan.

Moreover, while the integration with banks is a boon, it occasionally encounters hiccups with certain lesser-known banks, which can result in synchronization delays.

Conclusion

FinMinistry stands out in the digital finance management sector with its combination of user-friendly design and comprehensive tools. While some may find the limitations of the free version restrictive, the platform’s capabilities in budgeting, account integration, and real-time insights present a valuable resource for individuals intent on mastering their financial health. FinMinistry is an excellent choice for those seeking a balance between functionality and ease of use in financial management.

Visitors also viewed

FinMinistry Alternatives

Click2Sell

1 products

Alpha Affiliates

5 products

Paddle

0 products

Quid Affiliates

1 products

Edu-Profit.com

4 products

Essay Partner

5 products

Webpartners.co

3 products

ThriveCart

7 products

General Data

FinMinistry Information

- Languages

- English

Summary

Learn more

See Details

verified

Secure registration

Consultation available

FinMinistry Features

Explore FinMinistry features below, and see why users search for FinMinistry reviews before making their decision.

- Adaptive Budget Scheduler

- FinMinistry's Adaptive Budget Scheduler automatically adjusts budgeting recommendations based on real-time changes in spending and income patterns. This feature helps users optimize their finances effectively.

- Insightful Expenditure Alerts

- FinMinistry offers Insightful Expenditure Alerts, notifying users when spending habits deviate from set goals. Stay informed and make data-driven financial decisions.

- Custom Financial Insights

- FinMinistry's tailored financial insights provide users with personalized reports that highlight areas for potential savings based on individual spending patterns. This feature enhances financial awareness.

- Financial Wellness Check

- FinMinistry's Financial Wellness Check provides users a comprehensive overview of financial health, assessing factors like asset diversification and future planning.

Gain insights to improve your overall financial strategy. - Proactive Investment Tracker

- FinMinistry's Proactive Investment Tracker offers users analysis of potential investment opportunities based on trends and projections, aiding in informed decision-making.

- Goal-Oriented Savings Coach

- FinMinistry's Goal-Oriented Savings Coach guides users in setting and achieving personalized savings goals. This feature offers motivation tracking to enhance financial discipline.